Identification of Linear Movement in the Time Series of Ethereum Cryptocurrency Montly Transaction Volume through the SARIMA Model

DOI:

https://doi.org/10.14295/vetor.v33i1.15162Keywords:

Time Series, Ethereum, SARIMAAbstract

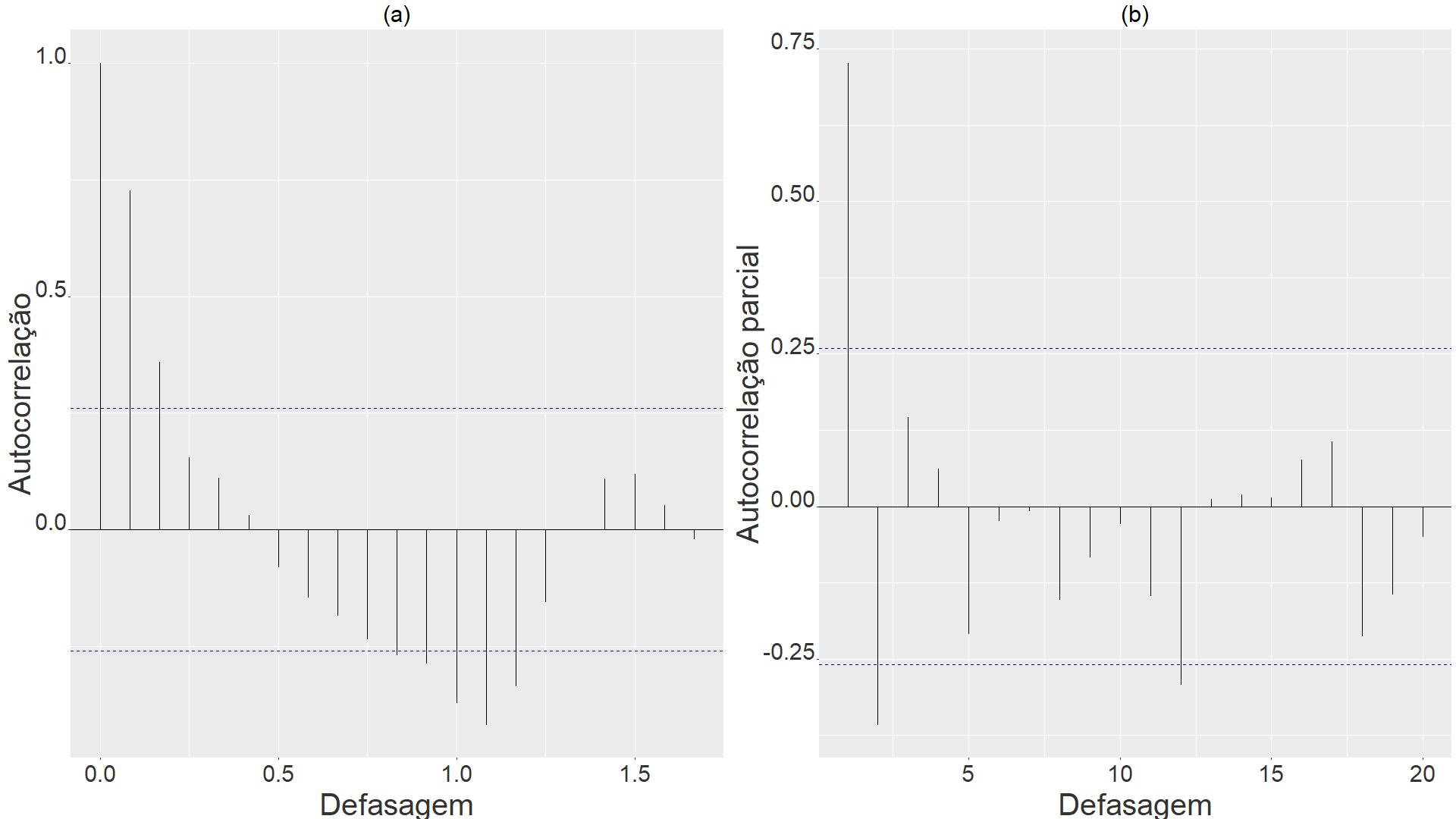

This work presents the modeling of the monthly volume of transactions of the Ethereum cryptocurrency through the Box-Jenkins methodology, involving the steps: exploratory analysis, identification, guarantee and validation, some of which performed using different techniques. The model found by the SARIMA modeling (Integrated autoregressive model of seasonal moving averages) was able to demonstrate the linear behavior of the data in a satisfactory way, but it was not enough to describe the behavior of the series, composed of linear and non-linear movement, being better represented by a hybrid model.Downloads

References

L. H. A. Müller, “Caminhos e sentidos da informação no mercado de ações,” International Review of Economics Finance, vol. 4, no. 6, pp. 133–164, 2005.

P. A. Morettin, Econometria financeira: um curso em séries temporais financeiras, 3a ed. São Paulo: Blucher, 2011.

J. D. V. Henao, V. M. R. Mejia, e C. J. F. Cardona, “Electricity demand forecasting using a SARIMA-multiplicative single neuron hybrid model,” DYNA, vol. 80, pp. 4–8, 2013. Disponível em: http://ref.scielo.org/b84jzw

C. Sigauke, “Forecasting medium-term electricity demand in a South African electric power supply system,” Journal of Energy in Southern Africa, vol. 28, pp. 54–67, 2017. Disponível em: https://doi.org/10.17159/2413-3051/2017/v28i4a2428

Y. Yang, Y. Chen, Y. Wang, C. Li, e L. Li, “Modelling a combined method based on ANFIS and neural network improved by DE algorithm: A case study for short-term electricity demand forecasting,” Applied Soft Computing, vol. 49, pp. 663–675, 2016. Disponível em: https://www.sciencedirect.com/science/article/pii/S1568494616303891

G. E. P. Box e G. M. Jenkins, Time series analysis : forecasting and control. San Francisco: Holden-Dayr, 1976.

P. A. Morettin e C. M. de Castro Toloi, Análise de séries temporais, 3a ed. São Paulo: Blucher, 2018.

V. L. D. de Mattos, L. R. Nakamura, A. C. Konrath, e A. C. Bornia, “Modeling the commercial electricity demand in Santa Catarina, using the Box-Jenkins methodology,” International Journal of Development Research, vol. 11, 2021, artigo no. 22265. Disponível em: https://doi.org/10.37118/ijdr.22265.06.2021

T. P. Pereira, V. L. D. de Mattos, A. C. Konrath, A. Bornia, L. R. Nakamura, e V. Vargas, “Estudo sobre testes de sazonalidade no volume mensal de transações da criptmoeda Ethereum,” em Anais da 20a Mostra de Produção Universitária (MPU – FURG). Rio Grande, Brasil: Universidade Federal do Rio Grande, 2021.

P. S. Thomaz e V. L. D. de Mattos, “Predicting the GFCF of the brazilian construction industry: a comparison between holt winters’ and SARIMA models,” Revista Gestão Industrial, vol. 15, no. 1, pp. 180–196, 2019. Disponível em: https://doi.org/10.3895/gi.v15n1.8590

I. Tahyudin, R. Wahyudi, e H. Nambo, “SARIMA-LSTM combination for COVID-19 case modeling,” IIUM Engineering Journal, vol. 23, no. 2, p. 171–182, 2022. Disponível em: https://doi.org/10.31436/iiumej.v23i2.2134

(2022) Coinmarketcap. Disponível em: https://coinmarketcap.com/

G. C. Chow, “Tests of equality between sets of coefficients in two linear regressions,” Econometrica, vol. 28, no. 3, pp. 591–605, 1960. Disponível em: https://doi.org/10.2307/1910133

D. A. Dickey e W. A. Fuller, “Likelihood ratio statistics for autoregressive time series with a unit root,” Econometrica, vol. 49, no. 4, pp. 1057–1072, 1981. Disponível em: https://doi.org/10.2307/1912517

D. Kwiatkowski, P. C. Phillips, P. Schmidt, e Y. Shin, “Testing the null hypothesis of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root?” Journal of Econometrics, vol. 54, no. 1, pp. 159–178, 1992. Disponível em: https://doi.org/10.1016/0304-4076(92)90104-Y

S. Hylleberg, R. Engle, C. Granger, e B. Yoo, “Seasonal integration and cointegration,” Journal of Econometrics, vol. 44, no. 1, pp. 215–238, 1990. Disponível em: https://doi.org/10.1016/0304-4076(90)90080-D

D. R. Osborn, A. P. L. Chui, J. P. Smith, e C. R. Birchenhall, “Seasonality and the order of integration for consumption,” Oxford Bulletin of Economics and Statistics, vol. 50, no. 4, pp. 361–377, 1988. Disponível em: https://doi.org/10.1111/j.1468-0084.1988.mp50004002.x

G. Schwarz, “Estimating the dimension of a model,” The Annals of Statistics, vol. 6, no. 2, pp. 461–464, 1978. Disponível em: http://www.jstor.org/stable/2958889

C. M. Jarque e A. K. Bera, “Efficient tests for normality, homoscedasticity and serial independence of regression residuals,” Economics Letters, vol. 6, no. 3, pp. 255–259, 1980. Disponível em: https://doi.org/10.1016/0165-1765(80)90024-5

R. F. Engle, “Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation,” Econometrica, vol. 50, no. 4, pp. 987–1007, 1982. Disponível em: https://doi.org/10.2307/1912773

R Core Team. (2023) R: a language and environment for statistical computing.viena, austria: R core team. Disponível em: https://www.r-project.org/

R. Hyndman, G. Athanasopoulos, C. Bergmeir, G. Caceres, L. Chhay, K. Kuroptev, M. O’Hara-Wild, F. Petropoulos, S. Razbash, E. Wang, F. Yasmeen, F. Garza, D. Girolimetto, R. Ihaka, D. Reid, D. Shaub, Y. Tang, X. Wang, e Z. Zhou. (2023) forecast: Forecasting functions for time series and linear models. Disponível em: https://pkg.robjhyndman.com/forecast/,https://github.com/robjhyndman/forecast

A. Trapletti, K. Hornik, e B. LeBaron. (2023) tseries: Time series analysis and computational finance. Disponível em: https://CRAN.R-project.org/package=tseries

D. Meyer, E. Dimitriadou, K. Hornik, A. Weingessel, F. Leisch, C.-C. Chang, e C.-C. Lin. (2023) e1071: Misc functions of the department of statistics, probability theory group. Disponível em: https://CRAN.R-project.org/package=e1071

G. N. Boshnakov. (2018) Fints: Companion to Tsay analysis of financial time séries. Disponível em: https://r-forge.r-project.org/projects/fints/

H. Wickham, W. Chang, T. L. Pedersen, K. Takahashi, C. Wilke, K. Woo, H. Yutani, e D. Dunnington. (2023) ggplot2: Create elegant data visualisations using the grammar of graphics. Disponível em: https://ggplot2.tidyverse.org,https://github.com/tidyverse/ggplot2

The Gretl Team. (2018) Gretl: GNU regression, econometrics and time-séries library. Disponível em: https://gretl.sourceforge.net/pt.html